Risk Management

Risk Management

Escape the Insurance Trap

The Insurance Trap looks like this:

-

- A business needs insurance coverage

- Insurance agent provides business with policy quotes

- Business selects the least expensive quote and their new policy is delivered

- One year later, it is time for business to renew their policy

- Insurance agent schedules a meeting with business to deliver the bad news of a rate increase

- This same process is repeated annually

- Business becomes frustrated because they find no value in their relationship with agent

- Business decides it is time to look for a new “Insurance Relationship” and fires agent

- Business hires a new agent and starts the same process over

The Insurance Agency Trap is:

- Quote-Driven

- Valueless to the Client

- A Race to the Bottom

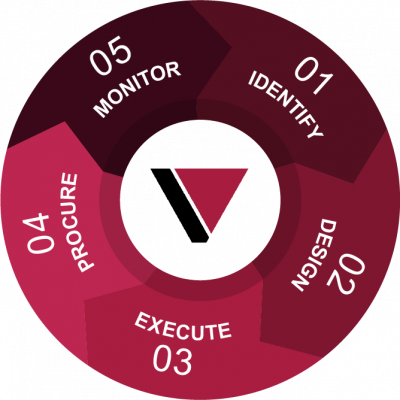

At BKCW, we take our clients out of the “Insurance Trap” by implementing our PIVOT Risk Management Process. This process-driven approach creates a strategic, long-term plan for managing risk and reducing employee healthcare costs.

Escape the Insurance Trap with

The PIVOT Risk Management process is how we help you escape from the Insurance Trap. We begin with a risk management audit, then we design strategies to mitigate risk, and execute those strategies. Lastly, we procure insurance and monitor your situation.